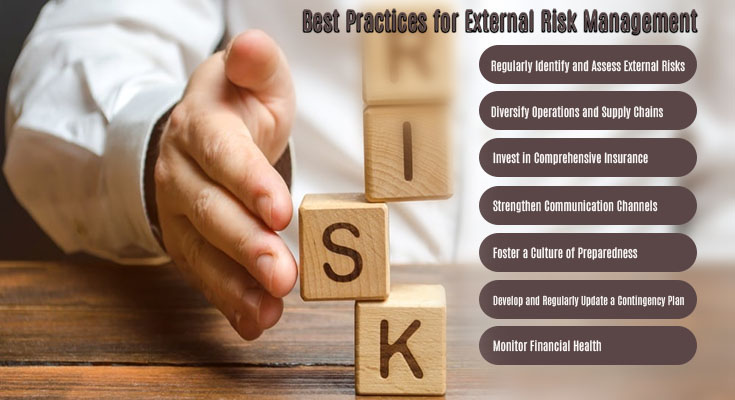

External risk management is the practice of identifying, assessing, and mitigating external threats that might negatively impact an organisation’s operations. In today’s globalised economy, these risks can emerge from a variety of sources: natural disasters, geopolitical shifts, and technological disruptions, to name a few. Proactively managing these threats helps ensure that a company can weather unexpected storms and remain competitive. Let’s delve into some best practices that can fortify your external risk management strategy.

1. Regularly Identify and Assess External Risks

Stay Updated: To safeguard against unforeseen external risks, you must first be aware of them. This means consistently monitoring news outlets, industry reports, and global events. Updated knowledge enables you to anticipate threats before they happen.

Use Technology: Leverage analytical and AI-driven tools that scan the environment for potential risks. These tools can help you pick up on patterns and trends that might signal a future threat.

2. Diversify Operations and Supply Chains

Think Globally: Don’t put all your eggs in one basket. Diversifying your operations and supply chains across different countries and regions can reduce the impact of a localised external threat.

Vet Suppliers: Investigate the stability and reliability of your suppliers and try to partner with those with robust risk management practices in place. This synergy helps ensure minimal disruption during crises.

3. Invest in Comprehensive Insurance

Cover All Bases: While insurance might seem an afterthought, it plays a pivotal role. Proper insurance ensures that you can recover faster financially after an unexpected event.

Regularly Review: As your business evolves, so do its risks. Frequently review and update your insurance policies to align with changing external threats.

4. Strengthen Communication Channels

Stay Connected: Establishing strong communication lines with stakeholders, suppliers, and customers is crucial. When everyone stays informed, it’s easier to adapt to changing circumstances collectively.

Use Modern Tools: Implement communication tools that provide real-time updates and alerts. These systems can be advantageous in rapidly changing situations, ensuring everyone remains on the same page.

5. Foster a Culture of Preparedness

Train Your Team: It’s not just about having a plan; it’s about ensuring everyone knows it. Conduct regular training sessions so your team knows how to react during external crises.

Encourage Feedback: Your employees might spot risks you haven’t considered. Create an environment where they feel comfortable sharing potential threats or concerns.

6. Develop and Regularly Update a Contingency Plan

Be Proactive: A reactive approach to external risks can be detrimental. Instead, design a proactive contingency plan that details the steps to take when faced with specific threats.

Test the Waters: Regularly run simulated risk scenarios – it will test the effectiveness of your plan but will also serve to prepare your team for real-life events.

7. Monitor Financial Health

Stay Liquid: External risks often come with financial implications. Maintaining a healthy cash reserve ensures your business remains operational during challenging times.

Re-evaluate Budgets: Adjust your budgets to prioritise critical operations during high-risk periods. Postpone less essential projects or expenditures.

In Conclusion

Effective external risk management requires vigilance, adaptability, and proactive measures. By regularly assessing potential threats, diversifying operations, investing in insurance, enhancing communication, cultivating preparedness, formulating contingency plans, and maintaining financial health, you can ensure that your business remains resilient and robust, regardless of external circumstances.

Remember, the key lies not in avoiding risks but in understanding and preparing for them. When you do, your business survives external threats and thrives in the face of them.